prepare and file UK Companies House accounts and HMRC tax returns and accounts filing

Documents

Are you a business owner in the United Kingdom seeking hassle-free and accurate UK Companies House and HMRC Corporation Tax filing services? Look no further! I offer comprehensive and expert assistance to ensure your company's annual accounts and tax returns are filed promptly and in compliance with UK regulations.

What I Offer:

1. Companies House Annual Accounts Filing:

- I will prepare and submit your company's annual financial statements to Companies House.

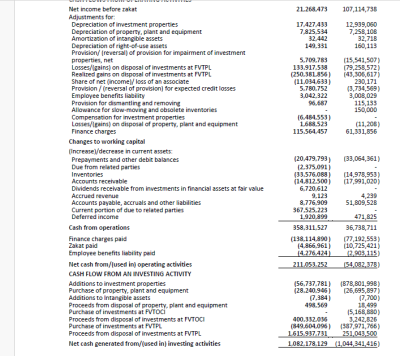

- This includes balance sheets, income statements, and all necessary supporting documents.

- I will also handle the submission of your Confirmation Statement and other essential filings to keep your company's information up to date.

2. HMRC Corporation Tax Return Filing:

- For limited companies, I will prepare and file your Corporation Tax Return (CT600) with HMRC.

- I'll ensure accurate calculation of your tax liability, deductions, and allowances to minimize your tax bill legally.

- I will also handle your PAYE (Pay As You Earn) tax returns if you have employees, ensuring compliance with employee-related tax obligations.

Why Choose My Services?

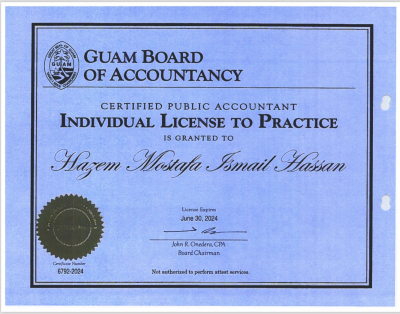

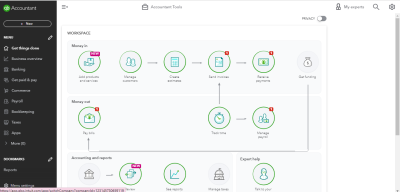

- Expertise: With a deep understanding of UK tax laws and accounting standards, I'll ensure your filings are accurate and in compliance with all regulations.

- Efficiency: Save time and reduce stress by entrusting these critical tasks to a seasoned professional.

- Deadline Adherence: I am committed to meeting all filing deadlines to avoid costly penalties and interest charges.

- Tailored Solutions: Every business is unique. I'll customize my services to meet your specific needs and budget.

- Peace of Mind: With my services, you can focus on growing your business while I handle the paperwork.

How It Works:

- Contact me with your requirements and company details.

- I will assess your needs and provide you with a personalized quote.

- Once agreed, I'll gather the necessary financial data and documents from you.

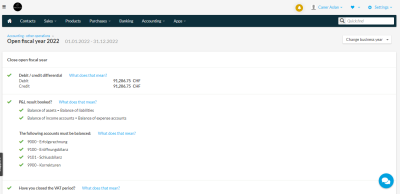

- I will meticulously prepare your annual accounts and tax returns.

- You'll have a chance to review the documents for accuracy.

- After your approval, I will submit everything to Companies House and HMRC on your behalf.

Don't let the complexities of Companies House filings and Corporation Tax returns overwhelm you. Trust my expertise to ensure your business remains compliant and financially optimized. Contact me today to discuss your needs, and let's get started on your path to financial peace of mind. Your success is my priority!

About The Seller

All My Skill

From

Member since

September 2023

Avg. response time

0 minutes

Last delivery

0 minutes

Language

English

Meet a Versatile Accounting & Taxation Expert with Over 25 Years of Experience! An APFA, ACA(P) with a rich experience in Profession. 6 years at GTI, in leading role and 15+ years in variety of industries, including telecom, oil and gas, environment, NGOs, textiles, foods & allied, I am confident in my ability to provide you with the best possible services. As IFAC body member committed to upholding the highest standards of professionalism and integrity in my work. You're an individual, a small business owner, or a member of a large corporation, I am here to help you. Let's work together.

FAQ

What do you need for Companies House Filing?

I will need your e-mail, Password, and Authentication Code of your UK company to enter the Companies House Portal.

What you need for HMRC Corporation Tax filing?

Your Company P&L and Balance Sheet will be required. If you have no Balance sheet, I will need your business account's trial balance to enter in the HMRC Portal.

What do you need to enter HMRC Portal?

I will need your Government Gateway ID and Passwords and Your Access Code once I will try to enter in your Company Portal.

Reviews

5

0

0

4

0

0

3

0

0

2

0

0

1

0

0

You may also like the following gigs