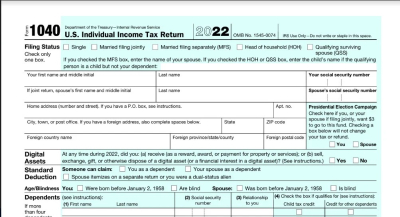

I will Set and Manage your Accounts on Quickbooks Online

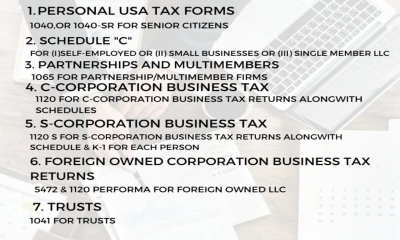

I have a Bachelor of Commerce degree in Accounting, accounting professional bodies memberships and over 25 years of Business Accounting Experience. This accounting experience is in diversified fields and covers almost all type of industries and sectors. Whether a Sole proprietor, LLP, PLC, CIC, Trust or any other form I can provide best solutions.

There are some sellers that offer 150 or even 200 transaction entries for their basic Gig. I offer up to 100 transactions entries for my basic $40 Gig package because I invest quality time and won't rush through what you provide.

I will:-

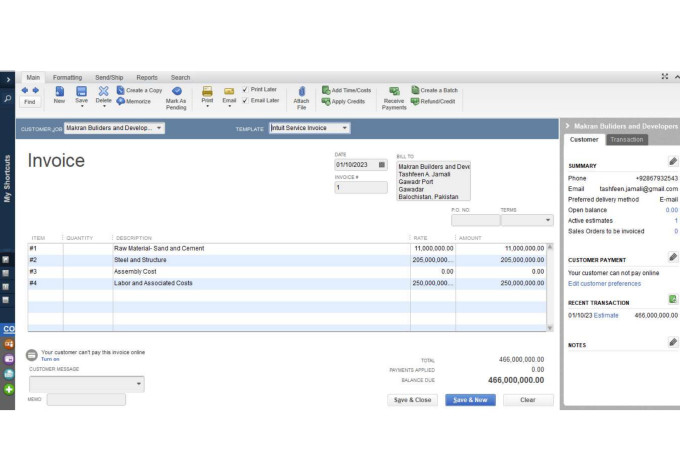

- Enter transaction from excel sheets

- Enter transaction from Google Sheet

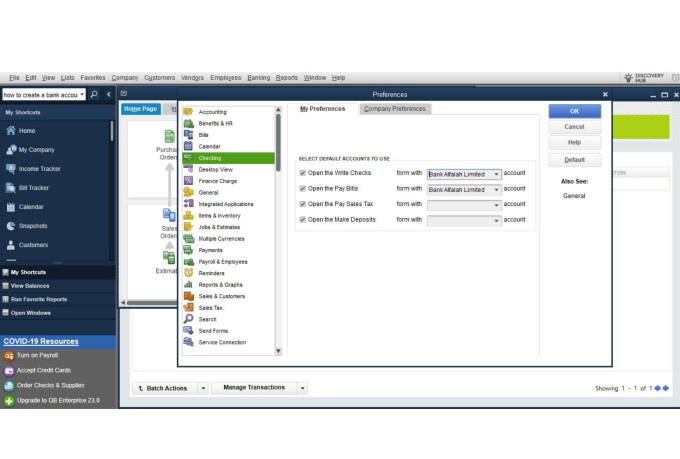

- Setup your Company Account in QuickBooks Online (QBO)

- Upload transactions from compatible Accounting Software to QBO

Please Note:-

- I DO NOT accept data entry orders over 500 transaction entries

- I DO NOT put estimates until you provide substance for that

- I DO NOT work with .pdf files. Please give me a source file like (.xls, .csv, etc.,)

I AM AT YOUR SERVICE SO PLEASE FEEL FREE TO PLACE AN ORDER NOW.

About The Seller

All My Skill

From

Member since

September 2023

Avg. response time

0 minutes

Last delivery

0 minutes

Language

English

Meet a Versatile Accounting & Taxation Expert with Over 25 Years of Experience! An APFA, ACA(P) with a rich experience in Profession. 6 years at GTI, in leading role and 15+ years in variety of industries, including telecom, oil and gas, environment, NGOs, textiles, foods & allied, I am confident in my ability to provide you with the best possible services. As IFAC body member committed to upholding the highest standards of professionalism and integrity in my work. You're an individual, a small business owner, or a member of a large corporation, I am here to help you. Let's work together.

FAQ

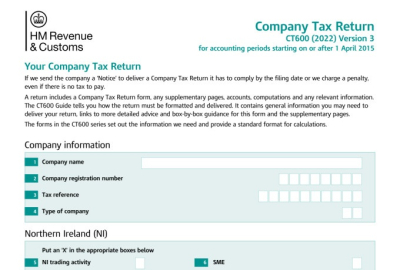

How experienced is your team in UK tax law?

Our team consists of highly experienced and qualified tax advisors who have a deep understanding of UK tax law and regulations. They stay up-to-date with the latest changes in the tax landscape and have a track record of successfully helping clients with their tax-related needs.

How do you determine your fees for tax advisory services?

Our fees are determined based on the complexity and scope of the work required. We provide a transparent and fair fee structure and can provide a detailed quote based on your specific needs.

What services does your tax advisory firm offer?

Our tax advisory firm offers a wide range of services, including tax planning, tax compliance, tax disputes, and representation before HM Revenue & Customs. We can help with personal and business taxes, including income tax, corporation tax, VAT, and capital gains tax.

Can you provide references from past clients you have worked with?

Yes, we are happy to provide references from past clients upon request. We take pride in our work and are confident that our clients will speak highly of the services we have provided.

How do you ensure confidentiality and security of my financial information?

We take the security and confidentiality of our clients' financial information very seriously. We have robust data protection measures in place and comply with all relevant data protection laws, including the General Data Protection Regulation (GDPR).

How do you stay current with changes in UK tax law and regulations?

Our team stays up-to-date with changes in UK tax law and regulations through ongoing training and education. We also regularly attend seminars and conferences, and stay informed through industry publications and newsletters.

Can you help with tax planning and advice for both personal and business taxes?

Yes, we can provide tax planning and advice for both personal and business taxes. Our team has a wealth of experience in helping individuals and businesses navigate the UK tax system and minimize their tax liabilities.

Have you handled cases similar to mine before and what was the outcome?

Yes, we have handled many cases similar to yours. Our team has a proven track record of success and we are confident in our ability to help you with your tax-related needs. Experience counts.

How will you communicate with me throughout the tax advisory process?

We will communicate with you regularly throughout the tax advisory process to keep you informed and updated. We are committed to open and transparent communication and will respond promptly to any questions or concerns you may have.

Can you provide a clear and detailed explanation of the tax laws and implications relevant to my sit

Yes, we can provide a clear and detailed explanation of the tax laws and implications relevant to your situation. Our team is committed to helping you understand the complexities of the UK tax system and making the process as straightforward and stress-free as possible.

Reviews

5

0

0

4

0

0

3

0

0

2

0

0

1

0

0

You may also like the following gigs